Australia's construction sector experienced a 3.6% decrease in dwelling approvals in November, reflecting supply challenges such as material shortages and changing market dynamics like increased demand for sustainable housing options. The decline affected both houses and apartments, with Queensland experiencing positive growth in house approvals, attributed to government incentives that stimulated housing construction activity despite the overall decline.

Key Points:

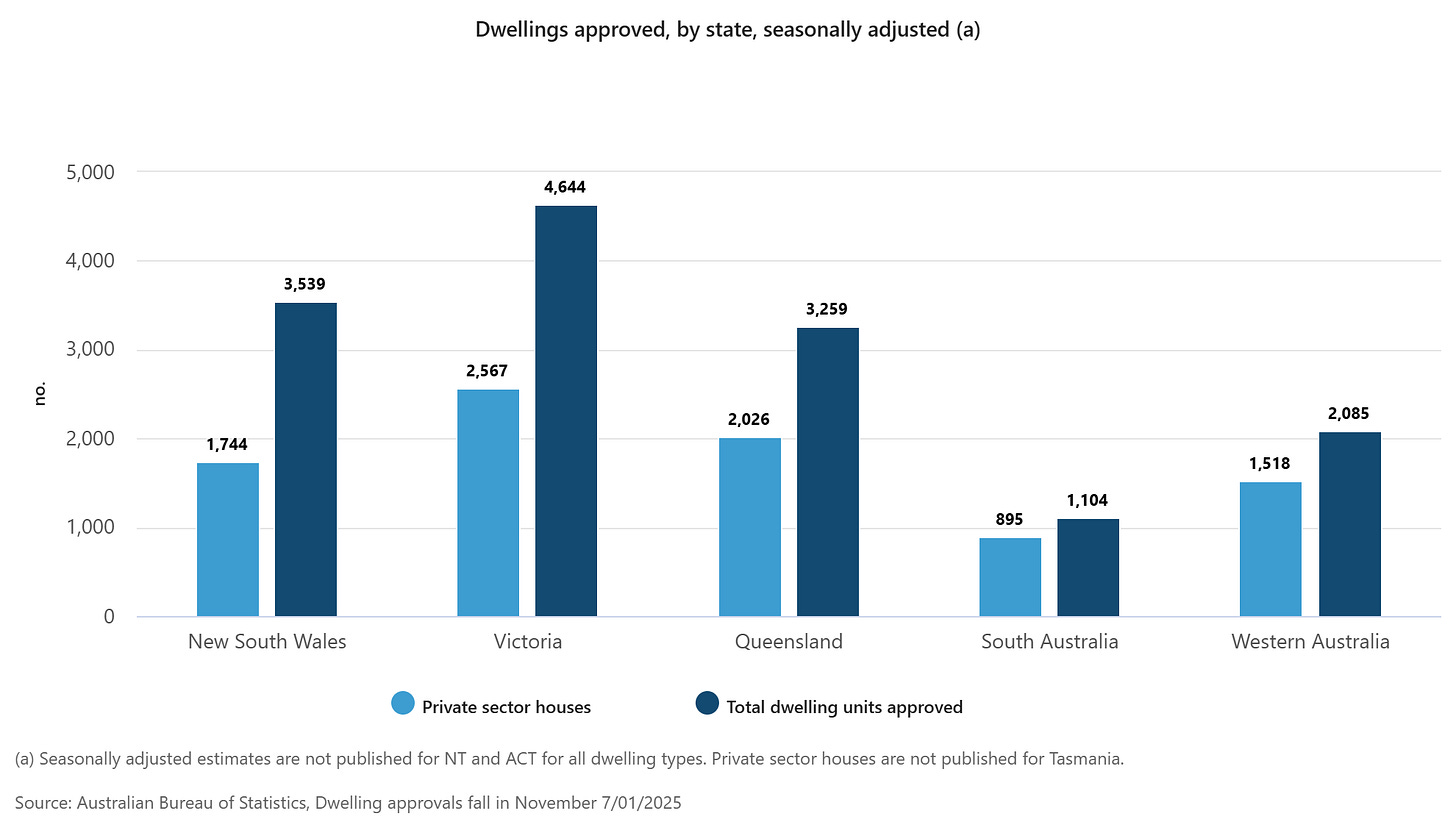

Total dwelling approvals dropped 3.6% to 14,998 units in November, with private sector houses falling 1.7% and private dwellings excluding houses plunging 10.8%, indicating a broad-based slowdown in the construction pipeline influenced by labor shortages and rising material costs.

Queensland emerged as the sole state showing growth in private sector house approvals with a 4.3% increase, while other states experienced declines, particularly in apartment approvals in New South Wales and Victoria

Despite the monthly decline, total dwelling approvals in November remain 3.2% higher than the same period in 2023, indicating a consistent growth trend in the housing sector.

Non-residential building approvals showed strength with an 18.4% value increase to $5.96 billion, offsetting the residential sector's weakness

.

Why It Matters:

This decline in dwelling approvals could exacerbate Australia's housing supply challenges at a time when population growth and housing demand remain strong. The contrasting growth in non-residential building values suggests a potential shift in construction sector priorities, which could impact housing availability and affordability.

Big Picture:

These trends signal broader economic implications for Australia's construction industry, employment, and housing market. The divergence between residential and non-residential sectors, combined with regional variations, points to evolving market dynamics that could reshape urban development patterns and investment strategies."