📰 Australian Inflation Eases to 2.4% as Housing and Food Price Pressures Moderate

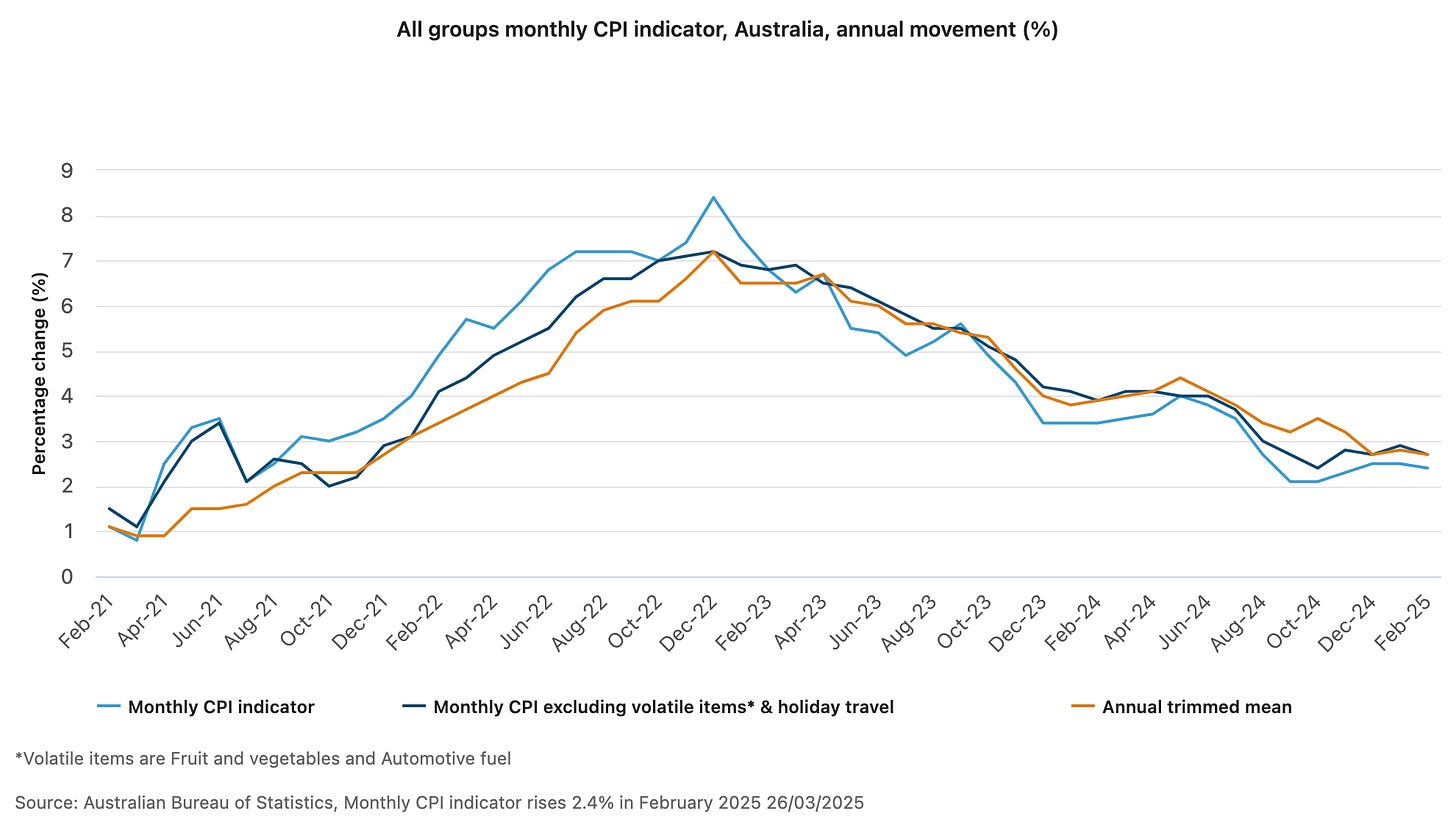

The most recent inflation figures point to a possible change in Australia's cost-of-living crisis as price pressures in key areas of household expenditure seem to be gradually relaxing. Over the twelve months preceding February 2025, the monthly Consumer Price Index (CPI) indicator rose 2.4%. This marks a minor drop from previous months and could help homes under financial strain in these unsure economic times.

Australian households may find some relief as the most recent inflation figures show that price rises are happening at a slower rate than in past years. Though there were indications that each category was starting to stabilise, the main causes of inflation still were groceries, alcohol, and housing.

For many homes, government electricity rebates have helped to lower total expenses; rental increases have finally slowed down following two years of explosive development. The inflation scenario would seem to be much different without these government subsidies, with electricity prices falling just 1.2% instead of the stated 13.2%.

Key Insights:

Inflation eased to 2.4% in February 2025, down from 2.5% in the previous two months

Food prices increased 3.1%, while housing costs rose at a slower 1.8% annual rate

Rental price growth hit its lowest level since March 2023, suggesting potential relief in the housing market

Government electricity rebates significantly impacted inflation figures, masking underlying price pressures

Why It Matters

"Annual CPI inflation was slightly lower in February, after holding steady at 2.5 per cent for the previous two months," noted Michelle Marquardt, ABS head of prices statistics. This moderation in inflation comes at a critical time for Australian consumers who have endured persistent price pressures in essential categories. The slowdown in rental growth to 5.5% annually – while still significant – represents the lowest increase since early 2023, potentially signaling a turning point in housing affordability. For homebuyers, the slowdown in new dwelling price increases to just 1.6% annually (the lowest since May 2021) suggests builders are now offering incentives to attract business in a cooling construction market.

The Bigger Picture

The gradual easing of inflationary pressures reflects broader economic adjustments taking place across Australia's economy. "Annual trimmed mean inflation was 2.7 per cent in February 2025. This was down slightly from the 2.8 per cent inflation in January and has remained relatively stable for three months," Ms. Marquardt explained.

This stability in underlying inflation measures suggests the Reserve Bank's monetary policy approach may be finally gaining traction. However, the heavy reliance on government energy rebates to suppress headline inflation figures raises questions about long-term price stability once these temporary measures expire.

The divergence between headline inflation (2.4%) and measures of underlying inflation (2.7%) underscores the complex nature of Australia's current economic environment, where policy interventions continue to play a significant role in shaping consumer price outcomes.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.

More on Mencari

5 - Minute recap - for nighly bite-sized news around Australia and the world.

Podwires Daily - for providing news about audio trends and podcasts.

There’s a Glitch - updated tech news and scam and fraud trends

The Expert Interview - features expert interviews on current political and social issues in Australia and worldwide.

Viewpoint 360 - An analysis view based on evidence, produced in collaboration with 360Info

Mencari Banking - Get the latest banking news and financials across Australia and New Zealand

The Mencari readers receive journalism free of financial and political influence.

We set our own news agenda, which is always based on facts rather than billionaire ownership or political pressure.

Despite the financial challenges that our industry faces, we have decided to keep our reporting open to the public because we believe that everyone has the right to know the truth about the events that shape their world.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support Mencari.

It only takes a minute to help us investigate fearlessly and expose lies and wrongdoing to hold power accountable. Thanks!