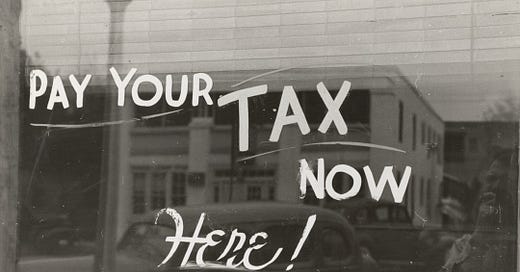

The Australian Taxation Office has raised concerns about an increasing tax evasion scheme that uses complicated related-party setups to claim fraudulent GST refunds. The Serious Financial Crimes Taskforce (SFCT) is coordinating a crackdown to protect Australia's tax system. The ATO is using advanced technology and partnerships to target businesses that employ complex company structures to claim fraudulent refunds, aiming to identify and stop these illegal activities. The ATO is taking action against these fraudulent schemes.

The Details:

The SFCT has identified multiple groups exploiting GST rules through sophisticated inter-related party structures designed to obscure fraudulent transactions.

Businesses involved in these schemes use fraudulent refunds to finance business ventures and personal purchases, giving them an unfair advantage over law-abiding taxpayers.

The ATO possesses advanced data matching and analytics capabilities, along with robust intelligence-sharing partnerships, to detect and prosecute financial crimes.

Authorities are providing businesses engaged in illegal arrangements with the chance to voluntarily disclose their activities before investigators reach out to them.

Why It Matters: This type of tax fraud directly impacts every Australian citizen by diverting funds away from essential public services such as healthcare, education, and infrastructure. Businesses that engage in these fraudulent practices break the law and unfairly outcompete honest businesses, distorting market competition and potentially destabilizing legitimate industries.

Big Picture: The increase in complex tax evasion schemes indicates a worrying development in financial crime that poses a threat to Australia's economic stability and social equity. This development necessitates stronger regulatory oversight and enforcement measures, while also highlighting the importance of maintain.

Got a News Tip?

Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn, or email. You can securely message him on Signal by using his username, Miko Santos.