Good evening. It’s Thursday, December 19, The ASX experienced one of its largest declines this year, with the Australian currency dropping to its lowest level since October 2022, largely due to US Federal Reserve easing interest rates.

First time reading? Join over 1000 curious readers. Sign up here.

As always, you can contact us with comments at editor@readmencari.com.

Let’s dive in - Miko Santos

MARKET CLOSE

Presented by CommSec

After the Fed signalled fewer rate reduction in 2025, the Australian market fell along with Wall Street, hitting a three-and-a-half-month low.

NEW ZEALAND

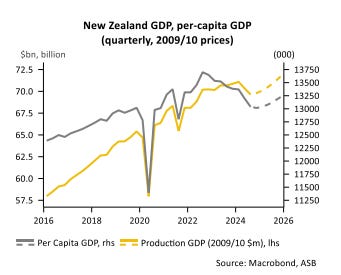

New Zealand Plunges into Deepest Recession Since 1991 as GDP Falls 1.0%

New Zealand's economy has slipped into its deepest recession since 1991, with two quarters of negative growth, which really raises questions about the state of the economy.

The country's economy contracted 1.0% in Q3 2024, weighed down by declines in manufacturing, construction, and services. Still, rate cuts from the Reserve Bank in recent months and strength in the agricultural sector point to better times ahead. This is the most significant economic downturn facing the country in over thirty years, aside from the COVID-19 period.

The Key Points:

Initial expectations were met with worse numbers, as Q2 growth was revised significantly lower to -1.1% from the previously reported -0.2%, revealing a more intense recession than earlier expected.

The goods-producing sector, which includes manufacturing, construction, and utilities, contracted by a significant 2.8% quarter-over-quarter, becoming the main burden on the economy.

The RBNZ previously cutting interest rates by 125 basis points since August seems reasonable, with economists now predicting more rate cuts to boost economic recovery.

The primary sector, in particular, had dairy and horticulture shine as one of the few bright spots in an otherwise difficult economic period, showing resilience with a positive growth of 1.4%.

Why It Matters:

This recessionary situation affects the everyday livelihood of New Zealanders on job security, business operability, and household economics. The severity of the recession forced the Reserve Bank to respond aggressively with interest rate cuts aimed at boosting economic activity. Consumers and businesses may feel partial relief as this will alleviate borrowing costs, although complete translation may take some time to be fully realized. Simultaneously, the incident has exposed the susceptibility of the economy to external economic pressure along with domestic challenges.

Big Picture:

This economic downturn has extensive consequences that go beyond immediate financial effects, influencing different aspects of New Zealand's economic environment. This recession might alter New Zealand's economic structure, potentially speeding up changes in crucial industries like manufacturing, services, and technology.

The impressive performance of the agricultural sector, especially in dairy, indicates a potential change in economic emphasis. The expected further rate cuts and predicted recovery through 2025 may open new opportunities in interest-rate-sensitive sectors. However, this is further complicated by global uncertainties, such as the probable political change in the United States.

HOUSEHOLD

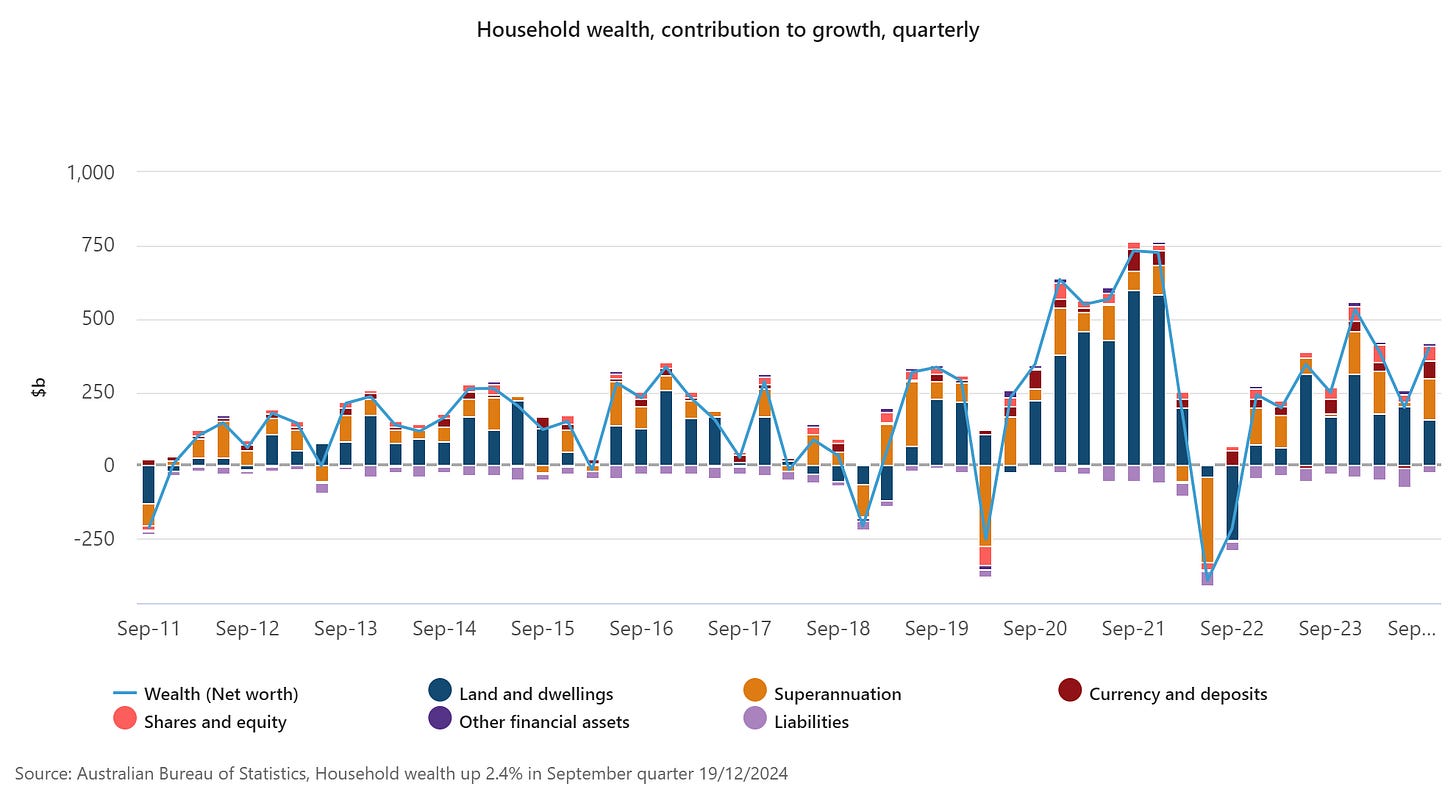

Australian Household Wealth Soars to Record $16.9 Trillion as Property Markets Defy Odds

Australian households recorded an eighth successive quarter of wealth growth in the latest ABS data to a record $16.9 trillion.

This resulted from: an increase in property values; a buoyant domestic and international share market; and superannuation balances. The ABS household wealth figures show a stellar 2.4 per cent rise in the value of household wealth for the September 2024 quarter and points to the strength of Australian household finances amidst turmoil in global economic markets.

The Key points:

In the September 2024 quarter, household wealth increased by 2.4%, reflecting $401 billion, in essence driven by increases in the value of residential property and increases within share markets.

Superannuation rose 3.5% to a total increase of $137.4 billion, assisted by the increase in the superannuation guarantee rate from 11.0% to 11.5%, which indicates an improving retirement savings outcome.

Household deposits increased 3.7%, to $61.5 billion, reflecting higher savings ratios and boosted by increased disposable income from stage 3 tax cuts.

Government credit demand reached levels not seen since 2020, with significant funding for cost of living relief measures; this shows a response to economic challenges and the need for financial assistance.

Why it matters:

This marked increase in wealth ensures that Australian households can rely on extra financial security as well as spending, allowing for economic activity. Nonetheless, it indicates the gaoing discrepancy in economics-whereby the main end is directed to those owners of property and individuals holding heavy superannuation account balance.

Big Picture:

The continued increase in household wealth, combined with increased government spending on cost of living relief, is a balancing act between economic prosperity and social equity. This could have a bearing on future policy decisions in the areas of housing affordability, superannuation reforms, and measures for wealth distribution that will shape Australia's economic landscape.

SUPPORT MENCARI

We're so grateful to our wonderful readers who make it possible for us to reach more than 1,000 inboxes with our fact-focused news. The Mencari (formerly Evening Post AU) readers are so important to us because they help us to continue spreading the word without any financial or political influence. Support Free and Independent Journalism

TECHNOLOGY & INNOVATION

Binance Australia Faces Court Over $13M Client Protection Breach. With $13 million already paid in compensation, ASIC is suing Binance Australia for allegedly misclassifying more than 500 retail customers as wholesale investors, depriving them of crucial consumer protections and causing them to suffer large losses.

10 Groundbreaking AI Trends Reshaping Technology in 2025. Tech writer Quinn Donovan provides insights into how artificial intelligence will change a variety of industries and everyday life by outlining ten key trends for the technology in 2025, such as advancements in healthcare, personalisation, ethics, and automation.

Honda and Nissan in Merger Talks, Creating $54B Auto Giant. As Japanese automakers look to compete with Chinese EV manufacturers and Tesla, Honda and Nissan are reportedly talking about a possible merger that would create a $54 billion automotive group that produces 7.4 million vehicles annually. Mitsubishi may also join the deal.

FINANCE & MARKETS

ACCC Blocks Catholic Health Australia's Private Insurer Boycott Plans. The Australian Competition and Consumer Commission (ACCC) is allowing Catholic hospitals to negotiate with health insurers and suppliers, but not to collectively refuse to work with large health insurance companies, in order to protect patients from disrupted care.

AGL Hit with $25M Penalty Over Centrepay Customer Refund Failures. AGL Energy will pay $25 million for failing to notify and refund 500 Centrepay customers, but the company says it won't affect its FY25 financial guidance.

Australia Places 21st, NZ 33rd in OECD Economic Performance Study. Australia was 21st and New Zealand 33rd out of 37 OECD economies in 2024, with Spain leading the pack, showing a significant performance gap between the two Pacific nations.

POLITICS & WORLD AFFAIRS

Wall Street Plunges After Fed Projects Fewer Rate Cuts Than Expected. The Federal Reserve cut interest rates slightly but announced fewer rate cuts than expected for 2025, causing a significant stock market drop because investors had expected more aggressive rate cuts.

Australia-Israel Relations Strain as Wong Maintains Gaza Ceasefire Call Despite Criticism. Diplomatic tensions exist between Australia and Israel because Australia is calling for a ceasefire in Gaza and increased humanitarian aid, whereas Israel strongly disagrees and criticises Australia's stance on the conflict.

Australian Military Aircraft Return with Citizens from Vanuatu. While Australia continues to assist in reestablishing the nation's commercial airport operations, two RAAF aircraft evacuated 148 Australians and brought aid to Vanuatu.

TRAVEL

Heathrow Announces £2.3B Private Investment for Major Airport Upgrades. Heathrow Airport received £2.3 billion in private investment for 2025–2026 to improve baggage handling, flight punctuality, and sustainability, the largest private transport investment in UK history.

KLIA Braces for Holiday Rush with 200,000+ Daily Passengers Expected. KLIA's terminals will handle over 200,000 daily passengers during the holiday travel surge between December 20 and January 5. Smart technologies and new flights will be implemented.

Juneyao Air Launches Sydney-Shanghai Route, Marking Historic China Capacity. Sydney Airport has achieved its highest-ever seat capacity to mainland China thanks to the launch of Juneyao Air's first Australian routes, which include four weekly flights between Sydney and Shanghai. Beginning on December 19, the airline also plans to connect Melbourne.

GAMES

Your click is an acceptance of Crossword Club's privacy policy and terms of use.

FROM THE TEAM

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

🎧 Check out our podcast, the one and only "Santos Unfiltered” - This podcast is an insightful conversation with people at the top of their game and deconstructs them to find the tools, tactics, and tricks to help you achieve your dream goal as Podcast Manager.

✍️ Give us a press release and a good-sized landscape photo. Make sure it's newsworthy. Send press releases to newsdesk@readmencari.com or click here. Editorially, we may rewrite headlines and descriptions.

🚀 Got a news tip ? Contact our editor via Proton Mail encrypted, X Direct Message, LinkedIn. You can securely message him on Signal by using his username, Miko Santos.

The Mencari (formerly Evening Post AU) readers receive journalism free of financial and political influence.

We set our own news agenda, which is always based on facts rather than billionaire ownership or political pressure. Despite the financial challenges that our industry faces, we have decided to keep our reporting open to the public because we believe that everyone has the right to know the truth about the events that shape their world.Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support The Mencari.